Why Should You Use an Accounting System?

In today's rapidly evolving technological landscape, adopting an accounting system is essential for any business striving for growth and sustainability. Whether you manage a small business or a large enterprise, an accounting system significantly enhances financial management and operational efficiency. Here are the key reasons why using an accounting system is crucial, especially in the Saudi market:

1. Compliance with Saudi Regulations

Government authorities in Saudi Arabia, such as the Zakat, Tax, and Customs Authority, enforce strict regulations on financial management and reporting. An accounting system ensures compliance by generating accurate reports that meet tax and zakat requirements.

2. Streamlining Financial Operations

Instead of relying on manual spreadsheets or paperwork, an accounting system automates financial processes like invoicing, tracking revenues and expenses, and managing payments. This reduces human errors and saves valuable time that can be invested in growing your business.

3. Accurate Financial Management

Accounting systems provide precise, real-time reports on your company’s financial performance, such as profit and loss statements, cash flow, and inventory. This data empowers you to make informed and strategic decisions.

4. Enhanced Operational Efficiency

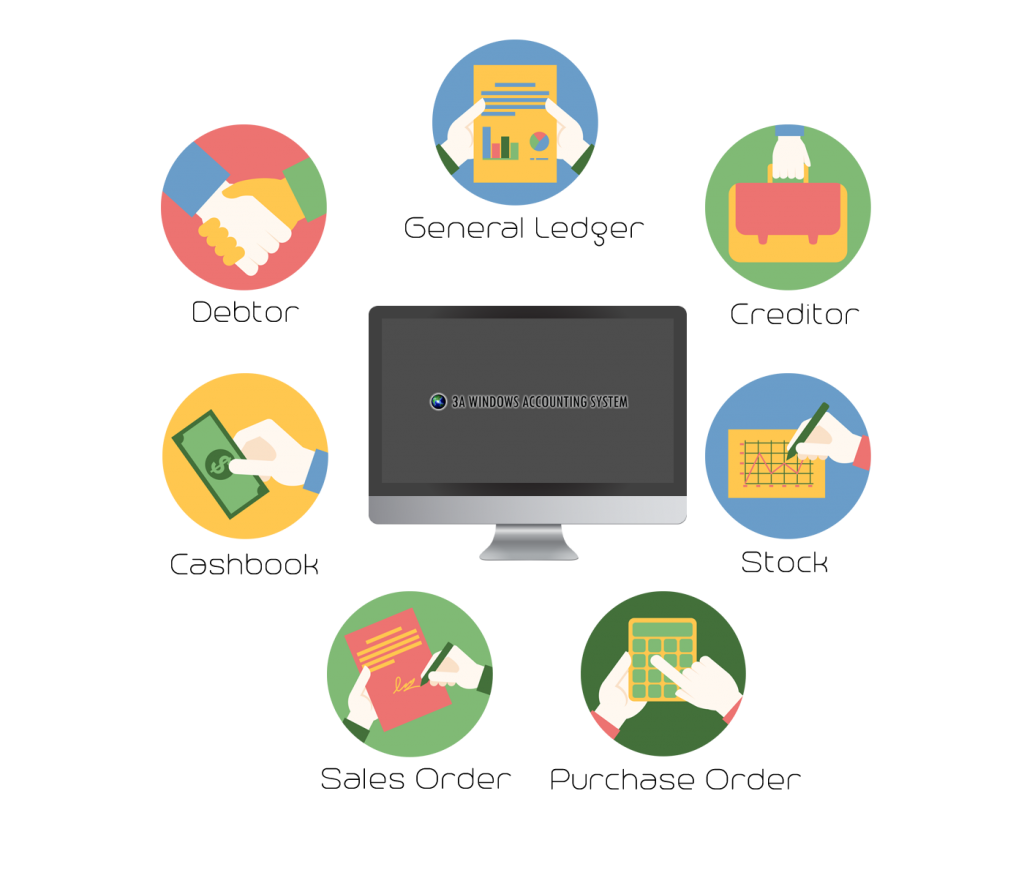

An accounting system improves operational efficiency by integrating with other systems such as Point of Sale (POS), Human Resource Management, and Inventory Management. For instance, linking inventory to accounting ensures that stock levels and prices are updated automatically.

5. Alignment with Saudi Vision 2030

As Saudi Arabia transitions towards a digitally-driven economy under Vision 2030, electronic accounting systems have become indispensable. These systems support this transformation by facilitating digital adoption and meeting financial governance standards.

6. Improved Transparency and Credibility

An accounting system maintains accurate and auditable records, boosting transparency and building trust with partners, investors, and stakeholders.

7. Customized Reporting

Advanced analytics features enable you to create tailored reports to monitor expenses, sales, or employee performance, ensuring the system meets your unique business needs.

8. Cost Reduction

While implementing an accounting system requires an initial investment, it saves money in the long run by minimizing financial errors and optimizing operational efficiency.

Tips for Choosing the Right Accounting System

When selecting an accounting system, ensure it:

Complies with zakat and tax requirements.

Supports both Arabic and English languages.

Offers integration with other systems.

Is user-friendly and accessible online.

Conclusion

An accounting system is not just a tool for managing numbers; it is a strategic investment that drives financial success and sustainability. In the competitive Saudi market, where regulatory demands are high, adopting an accounting system is no longer a luxury but a necessity.

Start now and secure sustainable financial growth!

Good

المحتوي رائع